The Santa Rally is one of the most discussed seasonal patterns in the stock market. It refers to a tendency for stocks to rise during the final stretch of the calendar year.

While the phrase sounds playful, the behavior behind it is supported by decades of market observation.

What Is the Santa Rally

The Santa Rally typically refers to the period covering the last five trading days of December and the first two trading days of January. During this time, the market has a history of drifting higher more often than not. This was first identified by analyst Yale Hirsch in the Stock Trader Almanac.

A commonly quoted phrase from Hirsch is

“Santa Claus tends to visit Wall Street nearly every year.”

Why Does the Santa Rally Happen

There is no single cause for the Santa Rally. Instead, it appears to be the result of several combined factors:

1. Light institutional trading

Large funds often reduce activity during the holiday period. With fewer institutional sellers, price may drift upward.

2. Retail investor optimism

Many individual investors buy stocks at year end. Some are driven by optimism and some by bonuses or tax related planning.

3. Rebalancing and window dressing

Portfolio managers may buy strong performing names into year end to improve the appearance of their holdings in reports.

4. Positive investor psychology

Holidays tend to produce a collective optimism that can subtly influence market sentiment.

5. Expectations of new capital in January

Traders may anticipate inflows at the beginning of the new year, which can cause pre positioning.

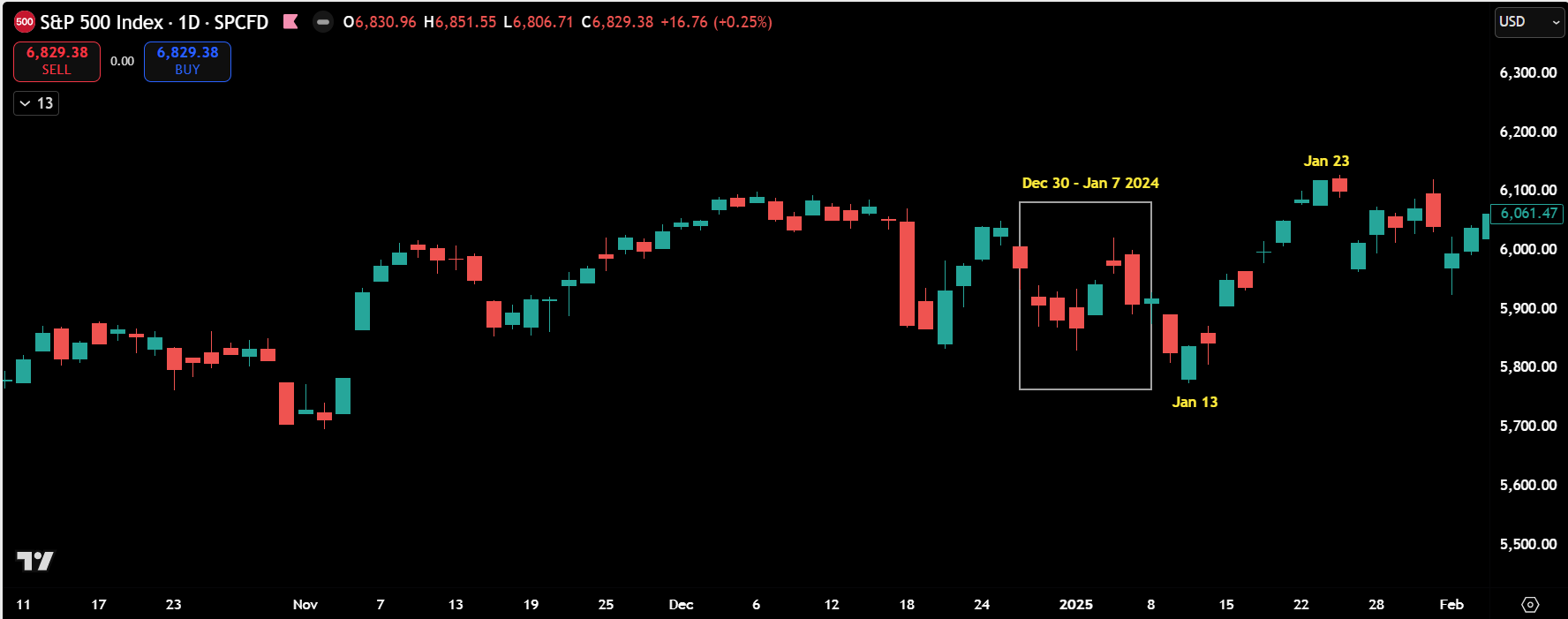

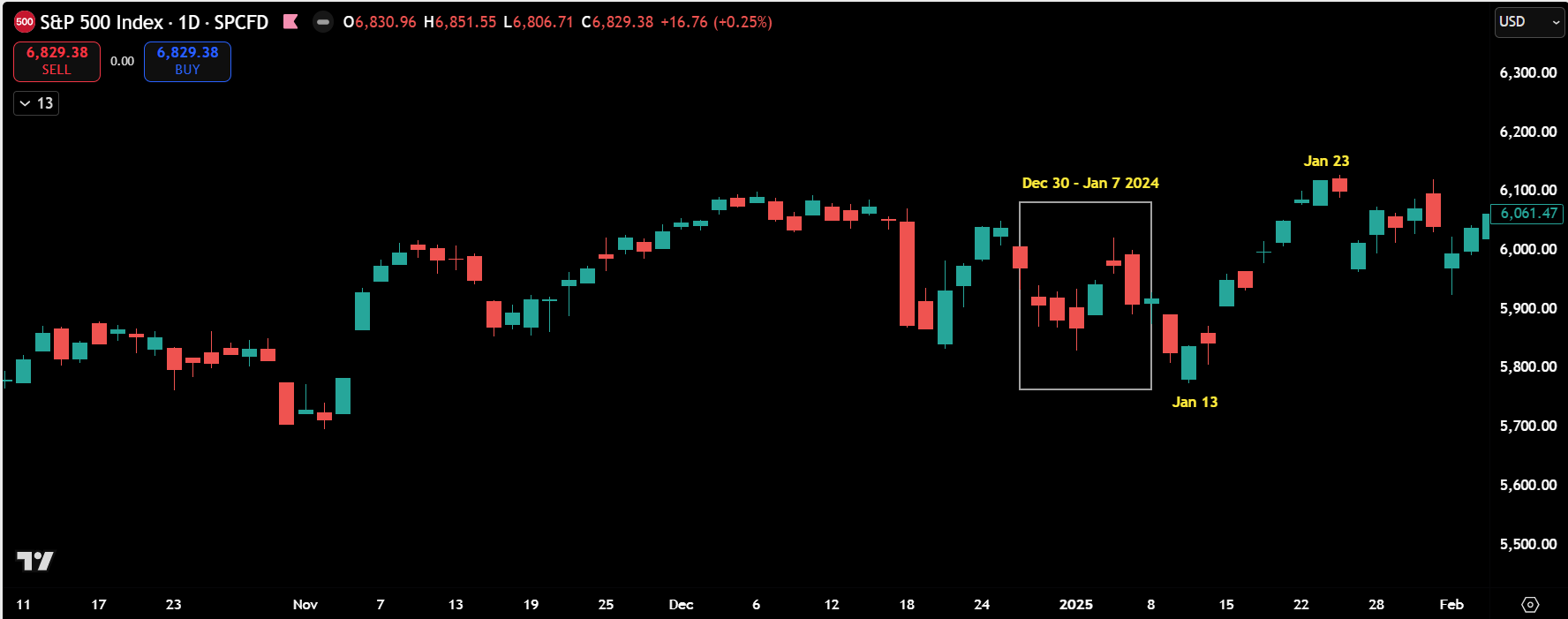

Fig 1- SPX Dec - Jan 2024

The market was in consolidation during the usually Santa Rally time so it continued consolidated but we did get a rally from Jan 13 - Jan 23

How Often Does the Santa Rally Occur

Historically, this period has been positive more often than negative. On average, the market has shown a mild upward bias during these seven trading days.

However, it is important to understand. The Santa Rally is a historical tendency, not a guarantee.

Some years produce only a minor gain. Some years fail entirely. Just like in 2024.

Fig 2 - SPX Dec - Jan 2023

We were in consolidation in 2023 but the market did move up after the consolidation.

What a Strong Santa Rally Suggests

When the market pushes higher during this period, it often implies confidence heading into January. This can signal:

- Healthy risk appetite

- Confidence in economic conditions

- Smooth beginning to the new year

What a Weak or Negative Santa Rally Suggests

Yale Hirsch also noted something interesting.

When the Santa Rally does not occur, it can be a warning sign for the coming year.

This scenario may suggest:

- underlying weakness

- institutional caution

- risk aversion

- potential early year volatility

This does not predict a crash, but it does indicate that investors may be less confident than usual.

Fig 3 - Spx Dec - Jan 2022

Price was in consolidation and rallied afterwards.

How Traders Can Use This Information

1. Do not over trade

This period is generally not one for aggressive speculation.

2. Watch the character of the market

- Is price drifting gently up

- Is it chopping sideways

- Is it selling off unexpectedly

3. Look at volume

Holiday volume is often thin.

Thin volume can exaggerate moves or weaken conviction behind them.

4. Be cautious with options

Time decay continues and liquidity may be reduced.

This can distort option pricing.

5. Focus on levels not predictions

Let the chart reveal intent rather than guessing.

Santa Rally and Your Trading Plan

For traders, the Santa Rally is not a signal, not a trade setup, and not a reason to buy blindly.

It is a contextual awareness of seasonal bias.

During this period, your trading plan might include

- Smaller positions

- Wider stops

- Fewer trades

- More observation

- Less emotional urgency

This season is excellent for reviewing your year, refining your edge, and planning for January when real volume returns.

Final Thoughts

The Santa Rally is a reminder that markets are influenced not just by data and numbers, but by human behavior, psychology, and collective mood.

It is not a prediction, it is a tendency.

It does not replace analysis, it complements it.

Smart traders use the Santa Rally as context to shape expectations and risk tolerance during a unique period of market behavior.